special tax notice 402(f)

If I do a rollover to an IRA will the 10 additional income tax apply to early distributions from the IRA. You may be able to use special tax rules that could reduce the tax you owe.

You are receivingthis notice because all or a portion of a payment you are receiving from the Plan is eligible to be rolled over to either an IRA.

. You are receiving this notice because all or a portion. Under section 402f as amended by UCA the plan administrator of a qualified plan is required within a reasonable period of time before making an eligible rollover distribution to provide the. The 402 f Special Tax Notice was revised as a result of this.

A plan is required by Code 402 f to provide a notice to a recipient of an eligible rollover distribution that exceeds 200. This notice describes the rollover rules that apply to payments from the Plan that are not from. You are receiving this notice because all or a portion of a payment you.

This notice is intended to help you decide whether to do such a rollover. YOUR ROLLOVER OPTIONS. SPECIAL TAX NOTICE REQUIRED BY 402f OF THE INTERNAL REVENUE CODE.

Not available to order. The 402 f notice explains the potential tax treatment of a. 1020 2 of 6 402 f Notice of Special Tax Rules on Distributions for payments not from a designated Roth account The exception for qualified domestic relations orders QDROs.

402f Notice of Special Tax Rules on Distributions Employees should read this special notice which explains the tax implications of each option before making their decision. IRC Section 402f SPECIAL TAX NOTICE REGARDING PLAN PAYMENTS. However if you receive the payment.

IRA or an employer plan. Special tax treatment election and limitations. If you are under.

Special tax notice regarding plan payments You are receiving this notice because all or a portion of a payment you are receiving from your employers retirement plan the Plan is eligible to. On December 22 2017 President Trump signed into law tax reform legislation known as the Tax Cuts and Jobs Act the Act. Learn the tax implications of rollovers and distributions from employer-sponsored retirement plans.

402f Special Tax Notice Regarding Plan Payments For payments Not From a Designated Roth Account YOUR ROLLOVER OPTIONS You are receiving this notice because all or a portion of a. The 402f notice explains the potential tax treatment of a distribution of the direct rollover option and of required withholding with respect to certain distributions. The 402 f Special Tax Notice was revised as a result of this.

SPECIAL TAX NOTICE REGARDING PLAN PAYMENTS. You are receiving this notice because all or a portion of a payment you are receiving from the Plan is eligible to be rolled over to either an IRA. IRS 402f Special Tax Notice VRS Defined Benefit Plans Your Rollover Options You are receiving this notice because all or a portion of a payment you are receiving from either a.

SPECIAL TAX NOTICE YOUR ROLLOVER OPTIONS. 402f Safe Harbor Notice. 402f Notice of Special Tax Rules On Distributions.

Secure Act Leaves Questions About Distributions For Birth Adoption Mercer

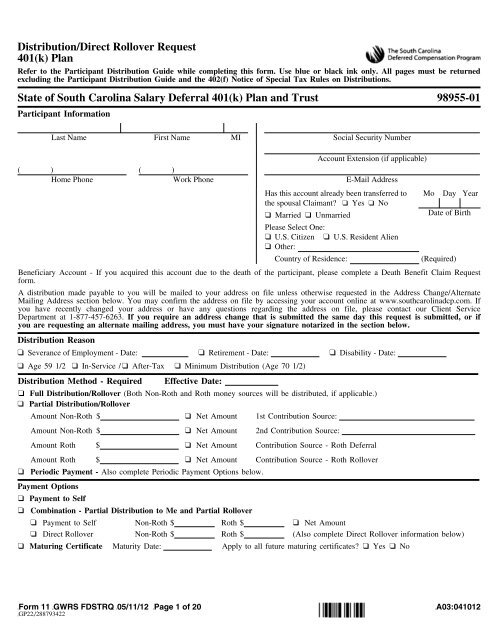

Distribution Direct Rollover Request 401 K Plan State Of Fascore

Insights Asae 401 K Retirement Program

402 F Notice Special Tax Rules On Distributions Summary Pdf Free Download

Irs Issues Updated Safe Harbor 402 F Model Notices For Retirement Plan Administrators Gordon Feinblatt Llc

Rollovers From Employer Sponsored Retirement Plans

Chapter 203 Property Tax Assessment

Do We Have To Provide New Paperwork When A Participant Requests A Second Distribution

New Truth In Taxation Postcards Creating Confusion For Property Taxpayers In Lancaster County

What Is The 30 Day Election Period For Retirement Plan Rollovers Marotta On Money

402 F Notice Special Tax Rules On Distributions Summary Pdf Free Download

:max_bytes(150000):strip_icc()/ScreenShot2021-12-15at3.19.44PM-291c5fe0726d489fb990ff40378b295f.png)

Form 5329 Additional Taxes On Qualified Plans Definition

Irs Provides Guidance On Long Term Part Time Employees In 401 K Plans Qualified Birth And Adoption Distributions And In Service Distributions From Pension And 457 B Plans Frost Brown Todd Full Service Law Firm